Crop Protection Products See Huge Increases in India

Agriculture plays an important role in the Indian economy. Roughly, more than 50% of the country’s population depends on the primary sector with all its forward and backward linkages. The sector’s overall contribution to GDP fluctuates between 15% and 19%. The challenges for India’s farming sector are enormous as it has to feed around 17% of the world’s population with a diminishing availability of farmland per capita and yields that are below global averages.

According to the latest Agriculture Census (2010-11), small and marginal holdings of less than 2 hectares account for more than 80% of the total farm holdings and close to 50% of the total farmed area. Improving the overall performance of the sector is crucial for ensuring long-term food security and increasing incomes of those linked to or fully dependent on the sector. From 1960 to 1990 India’s food grain production more than doubled to about 180 million tonnes, mainly driven by the Green Revolution. In 2014 the country produced around 270 million tonnes of food grains. This growth was achieved through the introduction of high- yielding varieties and improvements in crop protection technologies and general agronomic practices. The challenges ahead are daunting, where according to recent estimates India would require 450 million tonnes of food grains to feed its ever-growing population by 2050.

Rapid productivity gains have come on the back of intensive cultivation practices, which consequently exerted significant pressure on the countries natural resources. New pests and weeds have emerged due to the cultivation of varieties with a narrow genetic base – which if unmanaged, could negatively affect crop productivity in the coming years, with a consolidated loss potential of about $10 billion. Currently, about 20% of the yield losses on farms are due to insects, diseases, and weeds.

India’s diverse agro-ecological setting makes it home to a variety of crops, which provides a number of different pests multiple targets to feed on. Foremost, insect pests pose a serious threat to agricultural output – whereas weeds and diseases are of less concern, relatively. Lepidopteran species, especially Helicoverpa armigera, infest many of the commercially grown crops, causing severe economic losses for the farmers involved. Whitefly, especially this year, and aphids pose other threats. Among others, serious diseases include Puccinia striiformis (wheat), Phytophthora (citrus, potato etc.), Downy/Powdery mildew (grape), Xanthomonas (cotton and rice) and Pseudomonas.

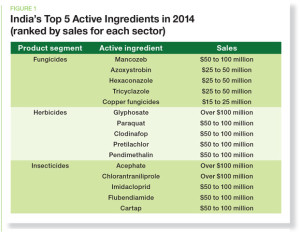

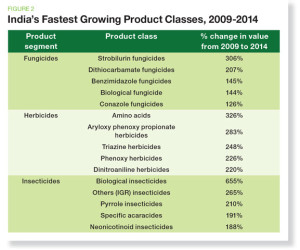

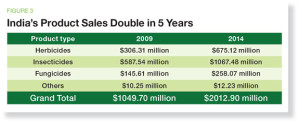

Improvement in agricultural productivity will also significantly depend on effective and sustainable crop protection, which will be instrumental in increasing farm incomes and freeing capital for reinvestments in further improvements within the sector. The general level of the use of crop protection in India is still rather low with an average of 400 g technical-grade pesticide used on a hectare. This is well below the global average of about 500g/ha. There is still huge potential in India for the use of crop protection products – especially considering that effectively only 60% of the cropped area is treated with crop protection solutions. According to the latest data by Kleffmann’s AgriGlobe consolidated crop protection and seed reference database, the country’s total crop protection market in terms of ex-manufacturer value in Harvest 2014 is estimated at $2.01 billion. As far as the segments are concerned, herbicides constituted 34%, insecticides 53%, and fungicides 13% of the overall consolidated market value. Among the crops, rice, fruits, vegetables, and cotton account for more than 80% of pesticide consumption in the country in terms of value. Biopesticides are also gaining importance in the Indian market, with market volumes as high as 7,000 mt to 7,500 mt in 2013/2014.

India’s crop output is heavily dependent on the Southwest Monsoon rainfall, which for 2015 is expected to be 10% to 15% deficient. Although sowing has been good for the kharif crop backed by healthy wet spells in July, the expected shortage could be crucial for the development of the kharif crops, especially in parts of Maharashtra, Karnataka, Telangana, Andhra Pradesh, Bihar and eastern Uttar Pradesh. This should, however, not dramatically affect the overall crop protection market.